How fairfax bankruptcy attorney can Save You Time, Stress, and Money.

Conversely, if The cash in the examining account does not qualify for any type of exemption, you must transform it about to your bankruptcy trustee. It'll be utilized to repay creditors. In some cases only Component of The cash within a checking account is exempt, when The remainder has to be submitted for the trustee. Somebody filing for bankruptcy underneath Chapter 7 might encounter an account freeze by a bank. You can Allow the bankruptcy trustee find out about the freeze and talk to them to get the bank to launch the freeze. The objective of the freeze is to hold the belongings from the examining account for creditors to collect on debts, Therefore the freeze really should be unveiled if you can clearly show which the resources are coated or partially lined by an exemption.

In Chapter 13 Bankruptcy, you might be able to lessen the principle of the secured credit card debt to the value of your collateral secured. Learn how it really works.

Debtors with a regular earnings can use Chapter thirteen bankruptcy to manage with their overwhelming debts, but you'll find lengthy-term effects for people to consider this route.

Covering a needed unexpected cost that has arisen, like a car or property repair, could rely like a result in for that courtroom to excuse a selected tax refund.

If they continue to don't halt, These are breaking the legislation. You might be able to sue them. They also cannot call you whatsoever several hours, get in touch with Other individuals about your credit card debt, threaten you with jail or bodily Visit Website harm, or use abusive language.

You can possibly maintain your examining account in Chapter seven bankruptcy if the funds are exempt and you also don’t owe dollars into the bank. Most banks will Enable you retain a examining account open when you file for bankruptcy.

Secured Debts – debts where the creditor has a security curiosity while in the house which was presented as collateral to the personal debt, such as a household mortgage loan or car Be aware.

In case you have amassed personal debt and they are not able to control, we can assist you get yourself a clean commence by filing a Chapter 7 Bankruptcy. blog here You shouldn't have to carry on struggling, let's wipe the slate thoroughly clean and start building.

You have sizeable personalized assets and don’t want to shed them to liquidation, foreclosure, or repossession. A major instance is if you have a great deal of equity designed up in click to find out more your house.

Discover: Be sure to usually do not include any private or sensitive information and facts in this type. This manner sends data by non-encrypted e-mail which is not safe. Submitting this way doesn't build find more info an attorney-shopper romantic relationship.

In Chapter thirteen bankruptcy, you might be allowed to retain all of your current home. However, When you've got nonexempt click this link property, you may be needed to pay back back again much more within your unsecured debts by way of your Chapter 13 system.

Both you and your attorney will go to a affirmation hearing. During this Listening to, the court will choose whether or not to approve your strategy.

After finishing all payments in the verified Chapter thirteen strategy, the court docket discharges your bankruptcy, which cancels the balances of qualifying debts. This does not include very long-phrase obligations similar to a property home loan, debts for alimony or child assist, and particular taxes.

In most cases, should you file for Chapter seven bankruptcy, you need to be able to maintain your bank account along with the dollars within it. This will likely rely upon your debts and exemptions. One example is, when you owe dollars to your bank, then the bank can deduct that cash from the account.

Jonathan Taylor Thomas Then & Now!

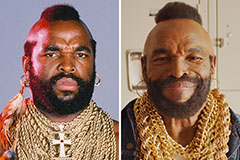

Jonathan Taylor Thomas Then & Now! Mr. T Then & Now!

Mr. T Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Jenna Von Oy Then & Now!

Jenna Von Oy Then & Now! Katie Holmes Then & Now!

Katie Holmes Then & Now!